Wealth management software provides portfolio management, trading, compliance and manager/sponsor communication capabilities. Charles River’s Wealth Management Solution aims to help wealth managers, private banks and financial advisors support discretionary and non-discretionary private wealth products, enhance mobility, and efficiently manage their book of business.

Wealth Management Software Platform Overview

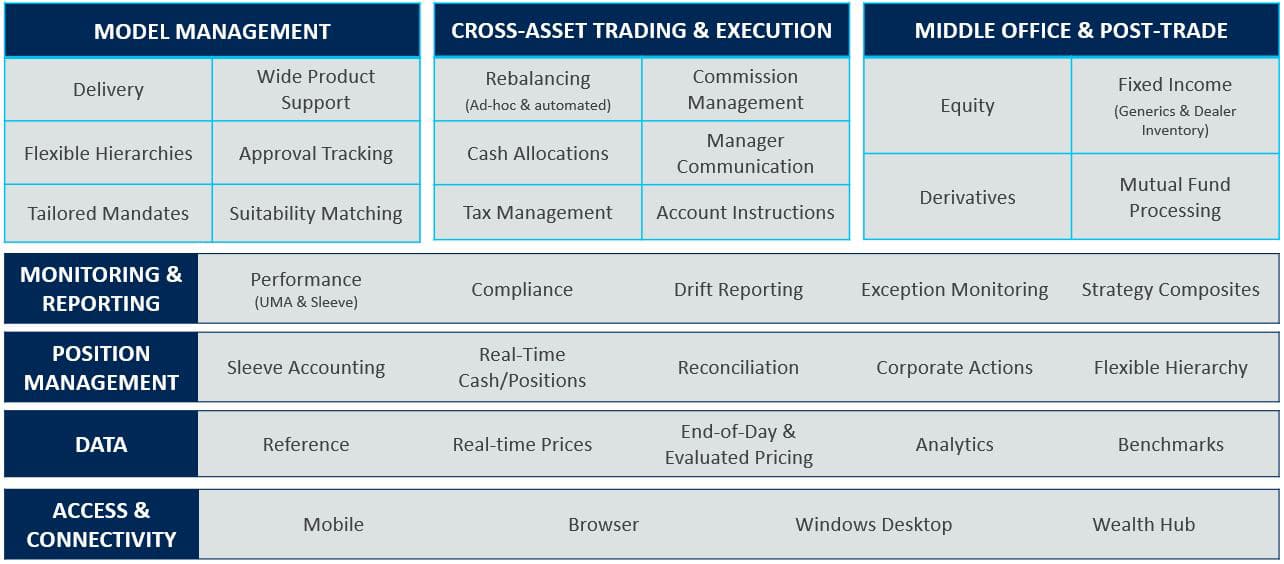

Comprehensive multi-asset/multi-currency functionality supports tailored portfolio strategies such as separately managed accounts (SMAs) and unified managed accounts (UMAs). Charles River Wealth Management Solution supports the entire investment lifecycle, including model management, portfolio management, trading, compliance, reporting, and position-keeping capabilities in a single, integrated solution.

Enterprise-Wide Scalability

Charles River helps improve scalability via the Central Workbench (CWB) and an Investment Book of Record (IBOR). The CWB supports exception-based workflows to identify accounts requiring attention and provides managed account overlay functionality that meets the demanding portfolio management requirements of high-volume sponsor firms. IBOR helps firms manage large volumes of accounts and positions, and is critical for managers running UMA programs whose accounting systems do not differentiate between sleeves.

An integrated Wealth Hub helps automate and streamline communication between asset managers and sponsors for model updates, trades/allocations, positions/cash, and intra-day account instructions. Charles River Anywhere provides browser-based access to a full suite of portfolio management tools integrated with an order and execution management system. It provides financial advisors with tablet access to key account information for improved engagement with high-touch client relationships.

Compliance & Surveillance

Charles River Wealth Management Solution provides extensive compliance and surveillance capabilities to help wealth managers and advisors mitigate reputational and regulatory risks. The solution automates compliance across the trade lifecycle and provides firms with centralized compliance monitoring and management.

Scalable compliance engines support high volumes of trades, compliance rules, accounts, and groups of accounts. Nightly portfolio compliance monitoring identifies portfolio drift against the Investment Policy Statement and flags any excessive exposures requiring action. Managers can minimize portfolio drift using automated rules-based rebalancing capabilities. A detailed audit trail captures all rebalancing and order generation activity for each session.

Charles River’s surveillance capabilities help firms adhere to Investment Policy Statement targets by supporting implementation and enforcement of client and firm mandates. Real-time auditing can flag suspicious trades and help enforce product selection suitability. A comprehensive view of portfolio holdings makes risk exposures and illiquid positions easily visible to wealth managers and compliance officers.

Wealth Insights & Videos

Charles River Wealth Insights: Recent Trends in the Wealth Management Industry

Why Your Clients Are Asking About Direct Indexing

Charles River & Qontigo: Powering Scalable Portfolio Customization

Viewpoints: Portfolio Customization in Wealth Management

The Path to Direct Indexing in Canada: Opportunities and Considerations

All About Wealth

Charles River Wealth Insights

Wealth ManagementCharles River Wealth Insights

Wealth ManagementDiscussion on recent wealth trends such as SMAs, simplifying Manager-Sponsor communications and developing a partner ecosystem.

Why Your Clients Are Asking About Direct Indexing… or will soon.

Portfolio CustomizationWhy Your Clients Are Asking About Direct Indexing… or will soon.

Portfolio CustomizationCharles River’s Head of Wealth, Randy Bullard, spoke on direct indexing at the recent Exchange Conference.

Charles River & Qontigo: Powering Scalable Portfolio Customization

Partner EcosystemCharles River & Qontigo: Powering Scalable Portfolio Customization

Partner EcosystemQontigo and Charles River discuss how we’re enabling customization at scale, powered by the Axioma Portfolio Optimizer.