Operating Model Design in Private Markets Investments

State Street AlphaOperating Model Design in Private Markets Investments

State Street AlphaA discussion on operating model design in Private Markets and insights on how investment firms are transforming to meet stakeholder demands.

Evolution of the Charles River and Qontigo Partnership

Partner EcosystemEvolution of the Charles River and Qontigo Partnership

Partner EcosystemThe Charles River and Qontigo partnership has provided firms with actionable performance and risk analytics across the investment lifecycle.

State Street Alpha for ETF Issuers

Exchange Traded FundsState Street Alpha for ETF Issuers

Exchange Traded FundsState Street Alpha now supports the entire ETF lifecycle with front, middle and back-office capabilities.

Helping Fixed Income Traders Keep Pace with Rapidly Changing Markets

Order and Execution ManagementHelping Fixed Income Traders Keep Pace with Rapidly Changing Markets

Order and Execution ManagementHow our OEMS platform helps institutional traders meet rapidly changing demands for best execution, trade automation and portfolio trading.

Charles River Wealth Insights

Wealth ManagementCharles River Wealth Insights

Wealth ManagementDiscussion on recent wealth trends such as SMAs, simplifying Manager-Sponsor communications and developing a partner ecosystem.

State Street Alpha & Rimes: Enhancing Index and Benchmark Data

Partner EcosystemState Street Alpha & Rimes: Enhancing Index and Benchmark Data

Partner EcosystemOur strategic partnership with Rimes provides institutional investors with a broad range of curated benchmark and index data.

Introducing CRD Academy

Charles River IMSIntroducing CRD Academy

Charles River IMSClients can access virtual instructor-led and self-paced training to gain an in-depth understanding of Charles River IMS tech and services.

State Street Alpha: Next-gen Data Management for Investment Firms

Alpha Data PlatformState Street Alpha: Next-gen Data Management for Investment Firms

Alpha Data PlatformJeff Shortis spoke at TSAM London to discuss how we’re helping investment firms provide their front office with data-driven insights.

Charles River & MSCI: Empowering Investors with Differentiated Multi-Asset Analytics and Data

Partner EcosystemCharles River & MSCI: Empowering Investors with Differentiated Multi-Asset Analytics and Data

Partner EcosystemHow our partnership empowers firms and asset owners with MSCI’s differentiated data and analytics, seamlessly integrated in Charles River.

Why Your Clients Are Asking About Direct Indexing… or will soon.

Portfolio CustomizationWhy Your Clients Are Asking About Direct Indexing… or will soon.

Portfolio CustomizationCharles River’s Head of Wealth, Randy Bullard, spoke on direct indexing at the recent Exchange Conference.

Charles River & Qontigo: Powering Scalable Portfolio Customization

Partner EcosystemCharles River & Qontigo: Powering Scalable Portfolio Customization

Partner EcosystemQontigo and Charles River discuss how we’re enabling customization at scale, powered by the Axioma Portfolio Optimizer.

MMI Advisory Insights: Navigating the Complexities of Delivering and Distributing Models

Wealth ManagementMMI Advisory Insights: Navigating the Complexities of Delivering and Distributing Models

Wealth ManagementAsset flows into model portfolios have been rising, presenting a growth opportunity for asset managers who wish to enter this space.

Alpha & FactSet: Leveraging Differentiated Data & Portfolio Analytics

Partner EcosystemAlpha & FactSet: Leveraging Differentiated Data & Portfolio Analytics

Partner EcosystemPartnering with Factset provides clients with differentiated analytics and data sources across the investment lifecycle.

FundGuard Investment Accounting in Charles River

Partner EcosystemFundGuard Investment Accounting in Charles River

Partner EcosystemWatch how FundGuard and State Street Alpha empower clients with a cloud-native, multi-book fund and investment accounting solution.

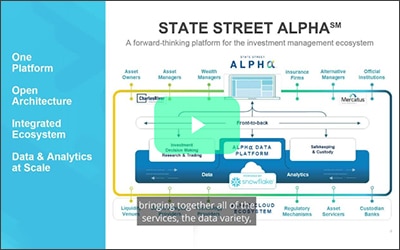

Modernizing Data Architecture for Capital Markets

State Street AlphaModernizing Data Architecture for Capital Markets

State Street AlphaThe Alpha Data Platform (ADP), powered by Snowflake, provides a fundamentally new approach to managing growing volumes of investment data.

Evolution of OEMS Strategies & Front-to-Back Platforms

Trading - OEMSEvolution of OEMS Strategies & Front-to-Back Platforms

Trading - OEMSWatch how open architecture, interoperability and front-to-back platforms are reshaping fintech for investment managers and asset owners.

Portfolio Management and Risk Analytics

Charles River IMSPortfolio Management and Risk Analytics

Charles River IMSA complete solution for portfolio construction and optimization, risk forecasting, performance attribution and scenario analysis.

State Street Alpha Data Platform (ADP)

DataState Street Alpha Data Platform (ADP)

DataLearn how the Alpha Data Platform (ADP), powered by Snowflake, helps consolidate and streamline data management.

Charles River & A360°: Optimizing the Digital Wealth Experience

Wealth Digital ExperienceCharles River & A360°: Optimizing the Digital Wealth Experience

Wealth Digital ExperienceCharles River and Advisor360° discuss the possible solutions to better leverage technology in the wealth space.

Welcome to State Street Alpha

State Street AlphaWelcome to State Street Alpha

State Street AlphaState Street Alpha can help you streamline and simplify your investment processes – All assets, faster insights, on one platform.

State Street Alpha for Private Markets

State Street AlphaState Street Alpha for Private Markets

State Street AlphaState Street Alpha for Private Markets provides a complete view of the investment lifecycle supported by a solid data management foundation.

State Street Alpha for Post Trade

State Street AlphaState Street Alpha for Post Trade

State Street AlphaState Street Alpha can empower you with the post-trade technology and services that best support your operating model.

State Street Alpha for Institutional Traders

State Street AlphaState Street Alpha for Institutional Traders

State Street AlphaInvestment managers use Alpha to execute trades across asset classes, demonstrate best execution, & make better informed trading decisions.

State Street Alpha for Portfolio Managers

State Street AlphaState Street Alpha for Portfolio Managers

State Street AlphaCollaborate & communicate more effectively with Alpha’s open architecture, choice of third-party, data and analytics.

Our ESG Solution

State Street AlphaOur ESG Solution

State Street AlphaLearn how we help investment firms and asset owners manage ESG focused portfolios.

Charles River IMS on Microsoft Azure

Charles River IMSCharles River IMS on Microsoft Azure

Charles River IMSCharles River IMS in Microsoft Azure helps firms innovate, bring new products to market quickly, and mitigate operational & security risks.

ESG for Wealth Management

Tailored Portfolio SolutionsESG for Wealth Management

Tailored Portfolio SolutionsCharles River and OpenInvest discuss fundamental changes and new opportunities for wealth management firms and individual investors.

Charles River Tailored Portfolio Solutions

Tailored Portfolio SolutionsCharles River Tailored Portfolio Solutions

Tailored Portfolio SolutionsCharles River’s Tailored Portfolio Solutions enables wealth and asset management firms to offer high-value portfolio customization at scale.

Gaining Visibility into Multi-Asset Trading Performance with BestX® and Charles River

TCA & TRADE ANALYTICSGaining Visibility into Multi-Asset Trading Performance with BestX® and Charles River

TCA & TRADE ANALYTICSOur partnership & seamless integration with BestX provides comprehensive transaction cost analysis (TCA) capabilities across asset classes.

The Evolution of Direct Indexing

Tailored Portfolio SolutionsThe Evolution of Direct Indexing

Tailored Portfolio SolutionsMMI & Charles River discuss industry trends and innovations in tech that have enabled the recent surge in interest around direct indexing.

Streamlining Wealth Manager and Sponsor Communications

Charles River Wealth HubStreamlining Wealth Manager and Sponsor Communications

Charles River Wealth HubThe Charles River Wealth Hub is the industry’s first API-driven open network solution, automating and streamlining connectivity.

Trader TV Interview: Charles River and BondCliq

Partner EcosystemTrader TV Interview: Charles River and BondCliq

Partner EcosystemCharles River’s collaboration with BondCliq helps ensure timely and comprehensive pricing data sourced from the largest broker/dealers.

Want to Learn More? See a Demo? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Looking for Tech Support?

CLICK HERE.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.