State Street Alpha® Data Platform

Your Data, When and How You Need It

State Street Alpha® Data Platform

Your Data, When and How You Need It

We help investment firms move faster by simplifying investment data.

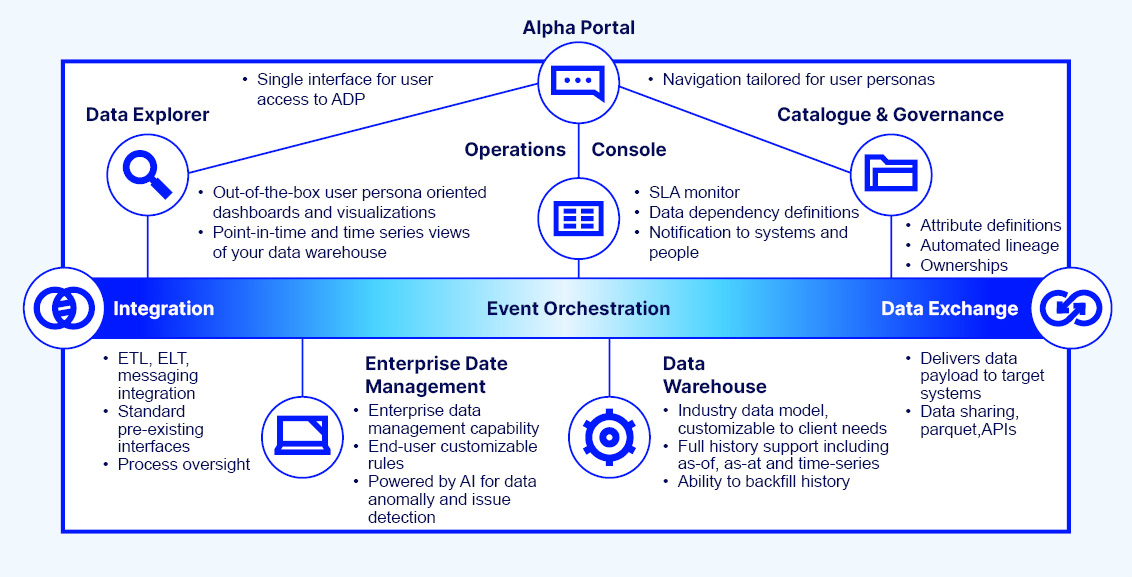

The State Street Alpha Data Platform (ADP) is the cloud-based, AI-enabled data solution that helps investment managers globally simplify the essential, but increasingly complex process of managing investment data. Our technology gives you access to investment data how and when you want it, giving you the confidence to make decisions quickly and decisively.

Further, ADP is a core component of State Street Alpha, offering many supplementary State Street services, so you can focus even more of your time on doing what you do best – driving value for your customers. To transform how you manage your investment data, contact us today.

Featured Webinar: The State Street Alpha Data Platform – Vision to Reality

A discussion on how we executed our Alpha Data Platform (ADP) vision and why harnessing data to inform decision-making, improve investment insights, and achieve faster time to market continues to be a critical need.

Artificial Intelligence Powers the Way

Getting to market fast is important, and incomplete, low quality data slows you down. To help you move faster, ADP’s Enterprise Data Management tool quickly produces high quality investment data at scale.

We are building Artificial Intelligence tools that help investment managers achieve better investment outcomes by combining the ever-growing capabilities of Artificial Intelligence (AI) with State Street Alpha’s front-to-back offerings.

Alpha Artificial Intelligence Data Quality Platform (AADQ)

The tool is then able to flag data exceptions that are worthy of your attention for remediation, speeding your organization’s ability to process data by pointing attention where it’s needed.

The best part is that the tool becomes smarter the more you use it, delivering you more and more value over time. The second best part is that this will be a core component of ADP’s Enterprise Data Management (EDM) offering.

Alpha Co-Pilot

Imagine being able to talk to your data and get real answers. View trends, retrieve data, ask questions about exceptions, it sounds amazing, right? We thought so too, so we started building it.

Alpha Co-Pilot is our up and coming AI tool that will allow you to chat with your data. You ask questions, and Co-Pilot will give you the answers.

Learn More

We're ready to answer your questions about our Data Management Platform.