Purpose-Built for Private Credit

Private credit has enjoyed robust growth in recent years as investors continue to seek alternative sources of returns and as demand grows from corporate borrowers.

While the growth continues, private credit investors are bracing for an inflection point driven by changing macro-economic conditions, increased competition, a maturing regulatory environment, and the accelerated adoption of AI-enabled technologies.

This evolving dynamic is driving many managers to:

- Prioritize data as an asset for performance & stakeholder engagement

- Look for opportunities to streamline operations and focus on core activities

Private credit remains woefully behind other asset classes in terms of technology adoption. The industry continues to rely on spreadsheets to acquire, manage, and report on investments, and has minimal access to real-time data or a reliable single source of truth.

As a result, private credit investors of all sizes spend most of their time trying to source, validate and populate data and minimal time analyzing data or deriving insight from it.

Webinar: Preparing for change with Private Credit analytics

Private credit is evolving rapidly, with quality opportunities shrinking and rising volatility adding pressure to portfolios. Discover how analytics can help investors navigate this shifting landscape with greater clarity and insight.

Webinar: How Leading Private Credit Investors are Unlocking Scale and Enhancing Portfolio Oversight

To learn how institutional investors are managing private credit portfolios at lower operational risk, check out our recent on-demand webinar.

Trust Your Data, Gain Better Insights

Charles River for Private Markets consolidates and normalizes investment data into a single platform for teams focused on Portfolio Monitoring, Deal Management, and Valuation Management. Break through your data silos and connect your technology point solutions to unlock access to faster insights and improved response times to LP queries.

Current Reactive State for Many Private Credit Investors

- Investment portfolios & client teams have grown in complexity, making it increasingly difficult to effectively monitor risk

- Processes for gathering and centralizing data continue to rely on dated technology & workflows

- The reporting and regulatory environment has begun to shift as LPs demand more data, and regulators focus on opacity and non-standardization of private markets as an asset class

Solutions with Charles River for Private Markets

- Centralized borrower and loan data in a cloud-based environment, built on a pre-defined data model purpose-built for Private Credit

- Technology & Managed Data Services to streamline borrower data collection

- Workflows to drive efficient and standardized processes across teams and departments and geographies

- Servicing most types of Private Credit, including direct lending, mezzanine, distressed, real estate, and infrastructure

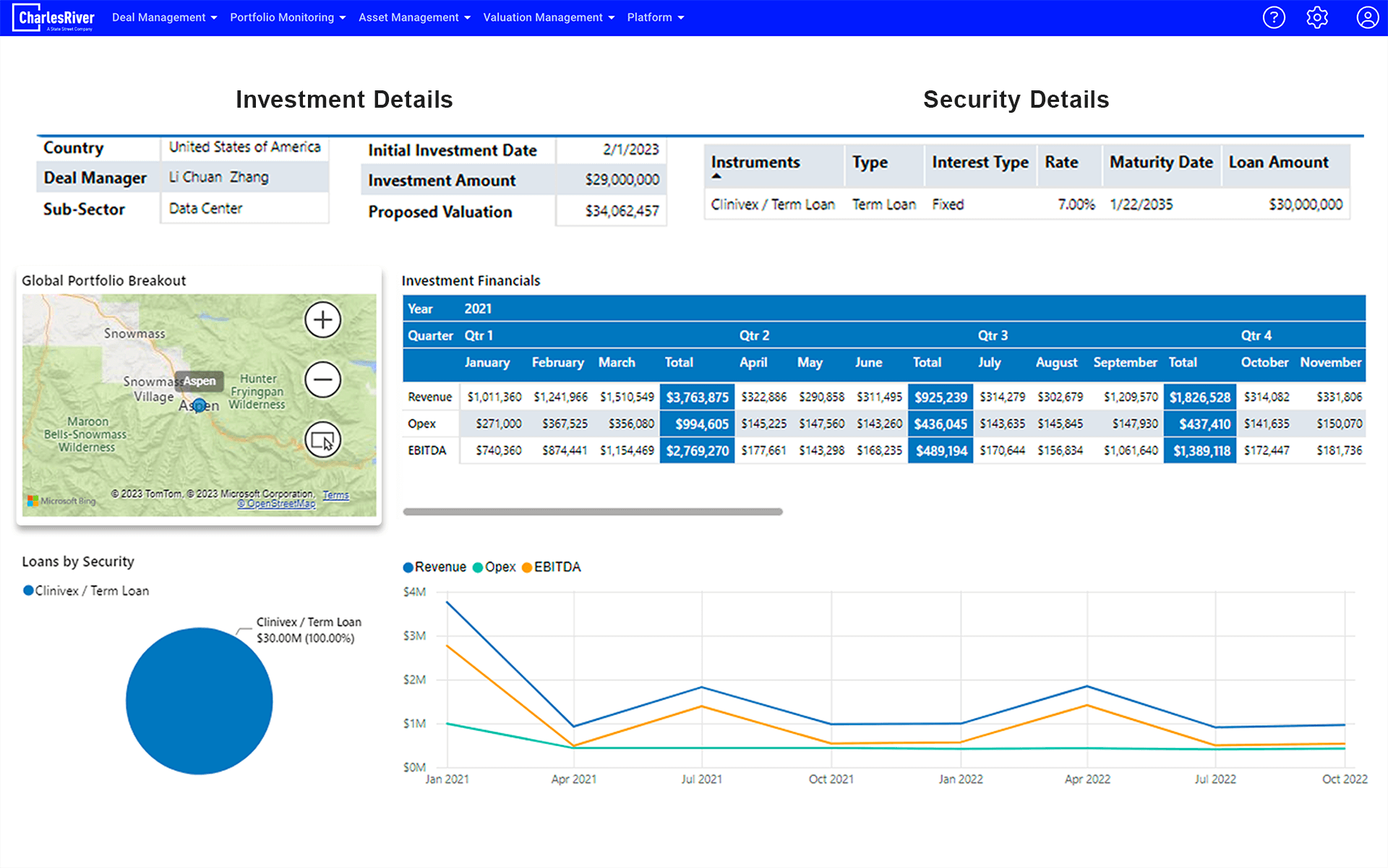

Charles River for Private Markets: Key Capabilities

Borrower Summary

- Make better data-driven investment decisions with data insights at security level

- Helps eliminate countless manual hours of data normalization process

- Streamlines QoQ key financials KPIs with data visualization

- Drill down from borrower level to security level with historical details

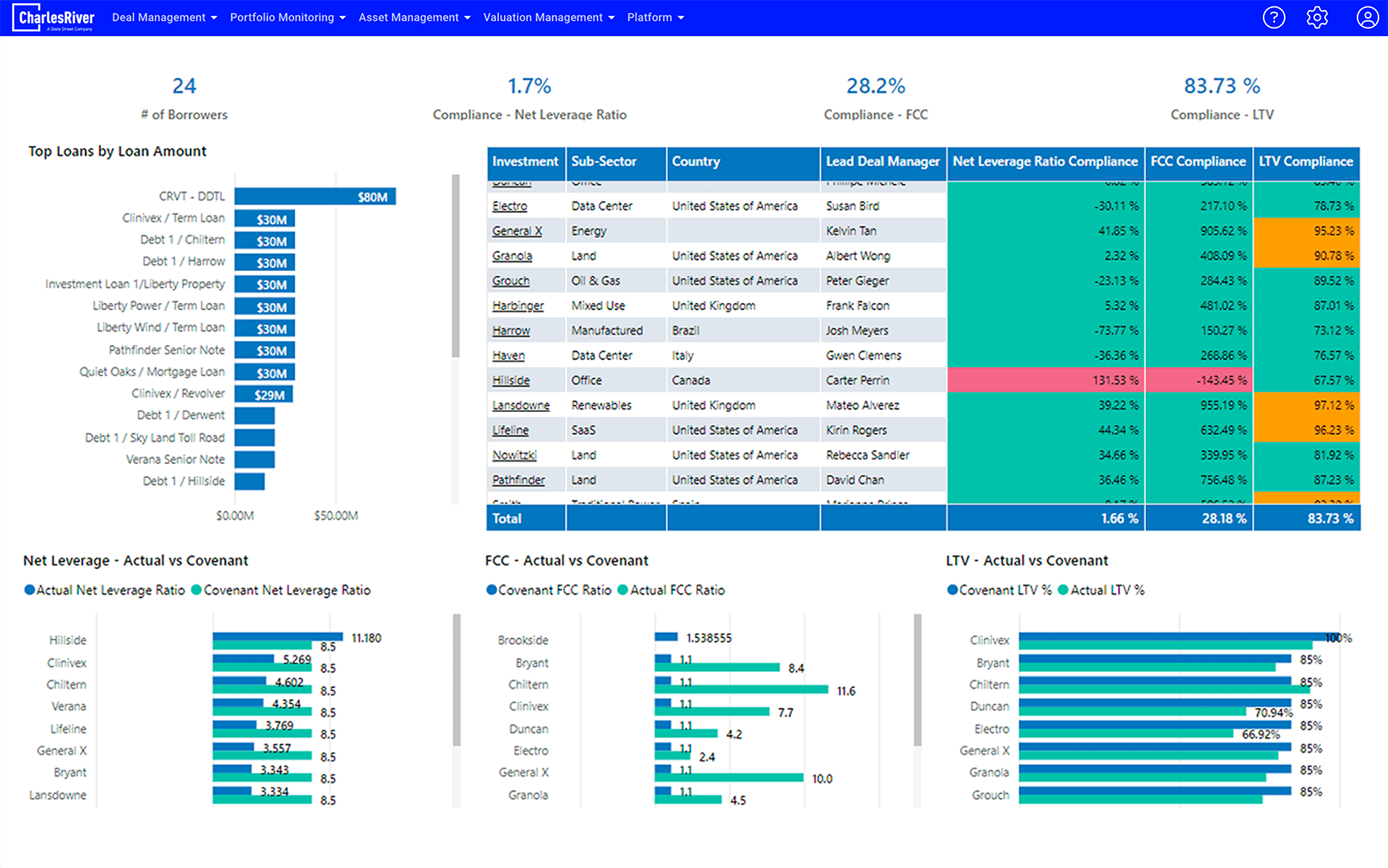

Covenant Tracking

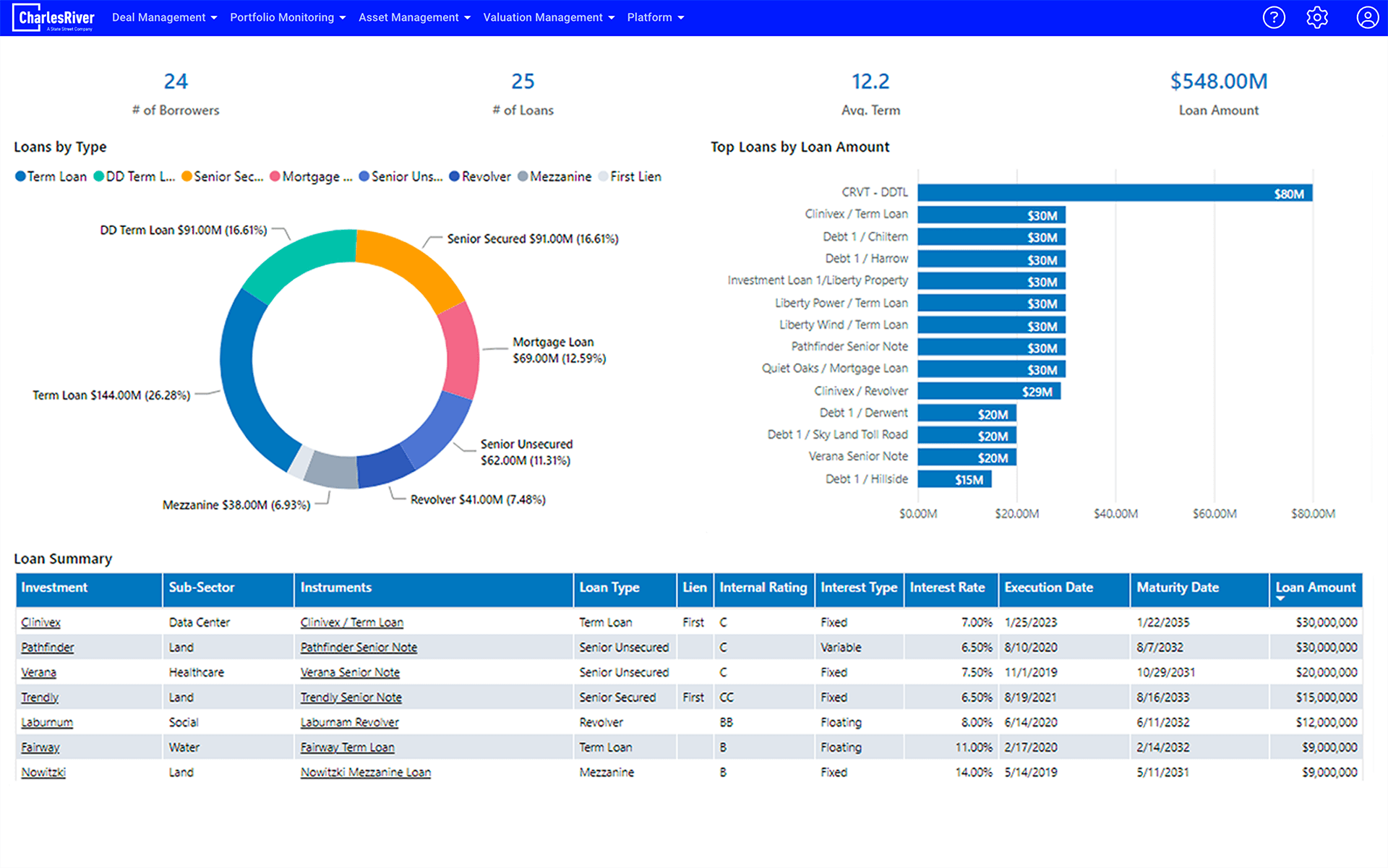

Loan Summary

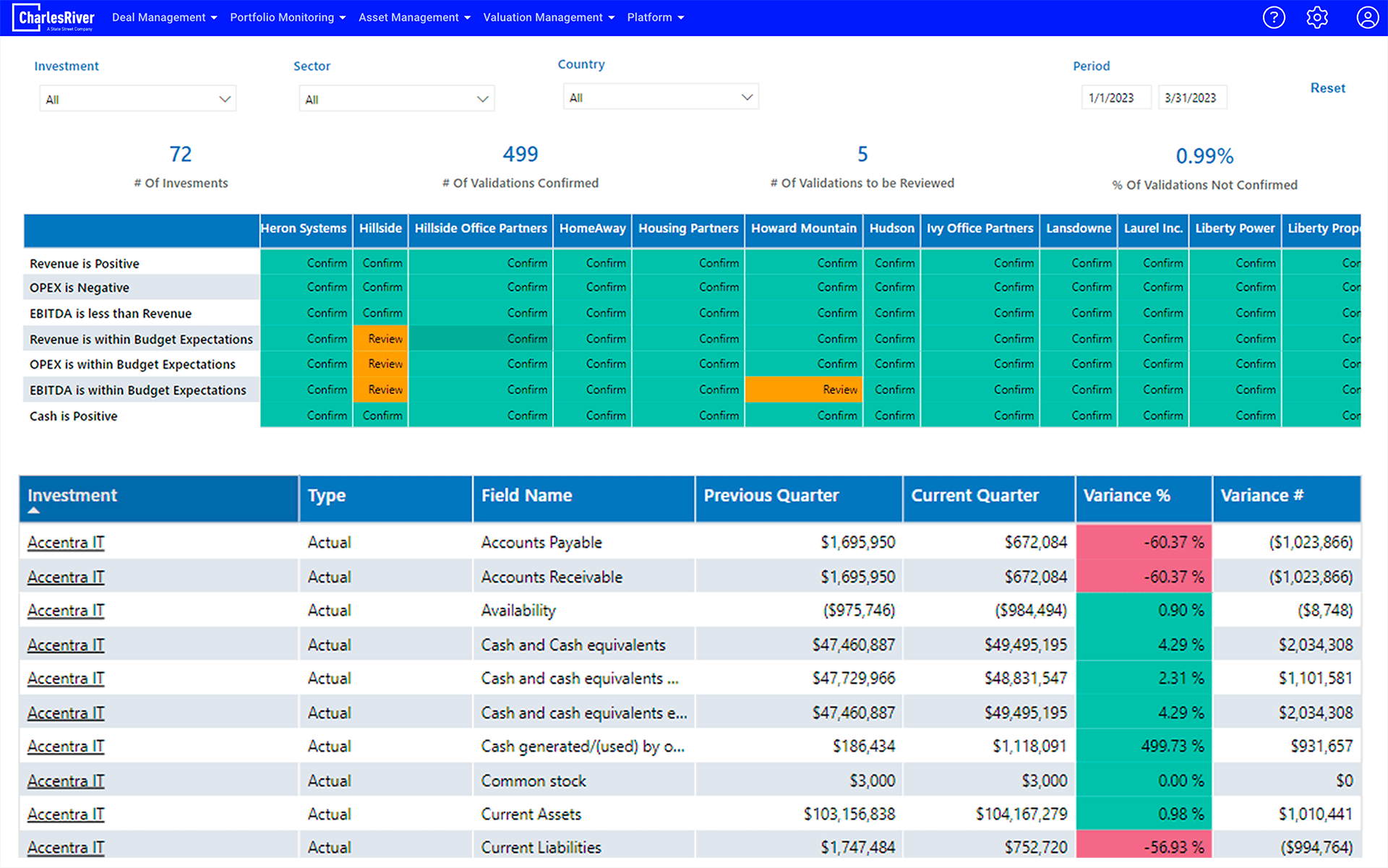

Data Quality

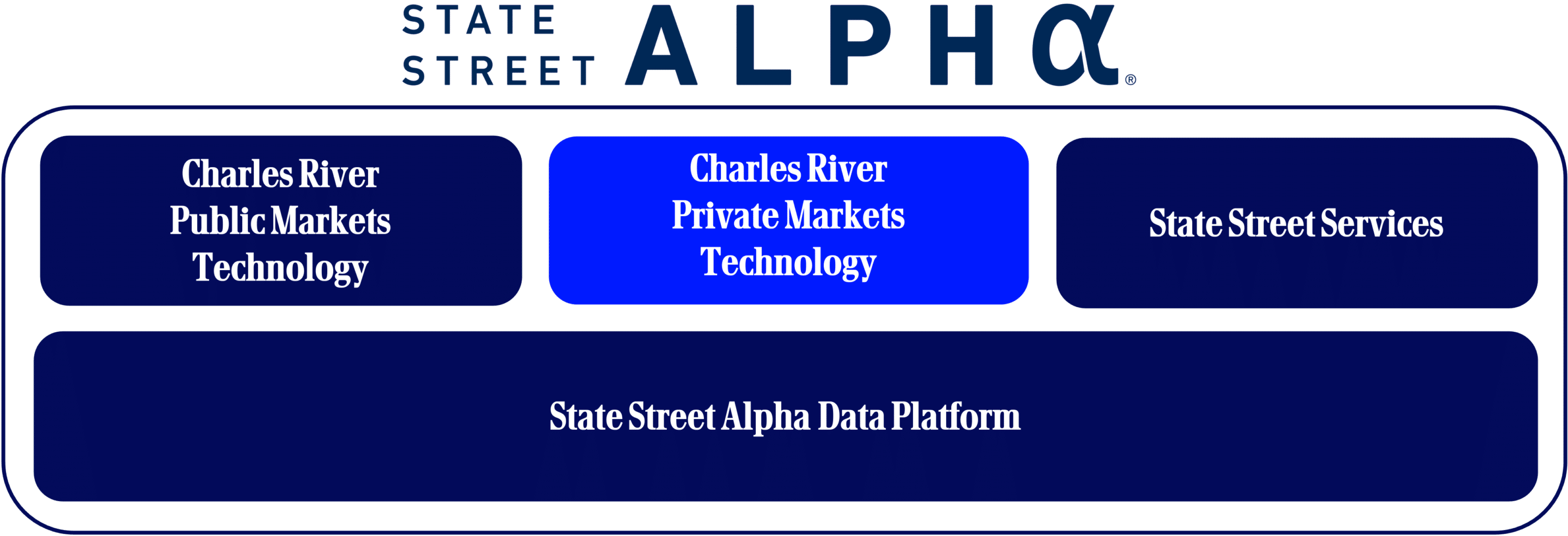

Part of a Larger Data Management Platform

Charles River for Private Markets enables firms to aggregate critical data and manage valuations and scenarios at scale. With timely portfolio monitoring, transparent deal management, realistic valuations, and consistent, accurate asset and ESG management, the solution enables investors and managers to unlock value and efficiencies required to be competitive in today’s environment.

Read our Blog

Future-Proofing Investment Management: The Role of Digital Transformation in Compliance, ESG, and Beyond

Compliance and regulatory reporting have become increasingly complex and demanding for investment firms.Our digital transformation blog series has discussed three key benefits driving investment manager interest in transformation initiatives, namely, the ability to...

How Data-Driven Decision making is Shaping the Future of Investing

In the investment management market, data, when refined through analytics, can empower decision-making and performance.In our current blog series, we’ve discussed the critical role of digital transformation in streamlining investment operations and improving the user...

How Digital Transformation is Redefining Client Experience

Today’s investors, whether institutional or retail clients, expect high-quality, technology-enabled interactions with their financial advisors and investment managers.In our previous blogs, we introduced digital transformation as a strategic imperative for investment...

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.

Request a Demo to Learn More

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.