Transitioning from LIBOR

The London Interbank Offer Rate (LIBOR) is a global benchmark, used across most major currencies and markets to set interest rates for a wide range of financial products, from mortgages to car loans and credit cards to installment loans. LIBOR is determined via a daily fixing, using quotes provided by a consortium of banks.

As of 2021, these banks will no longer be required to submit rate quotes needed to calculate LIBOR. This has resulted in a global, industry-wide initiative to identify suitable replacement rates and adapt existing curve construction and valuation methodologies.

Impacted Instruments

Directly impacted instruments* refer directly to one of the affected interest rate benchmarks and will need to change both terms and contractual foundations, e.g., derivatives, floating rate notes (FRNs), and loans. These include:

- Floating Rate Notes

- Exchange Traded Derivatives, including Interest Rate Options and Interest Rate Futures

- OTC Derivatives, including Cross Currency Swaps, Interest Rate Options, Forward Rate Agreements, Interest Rate Swaps

- Business Loans (syndicated loans, non-syndicated business loans, non-syndicated Commercial Mortgages)

- Non Agency Mortgage Backed Securities

- International Asset Backed Securities

- Collateralized Loan Obligations

- Asset Backed Securities, including Student Loans, Autos, Bank Cards and others

- Commercial Mortgage Backed Securities

- Mortgage Backed Securities

- Retail Mortgages, Consumer Loans, Student Loans

Indirectly impacted instruments use interest rate benchmarks for FX forward calculation or discounting.

*Source: ISDA Transition Roadmap

Ensuring LIBOR Transition Readiness

Charles River is working with industry stakeholders to help ensure buy side clients are prepared for this transition. Key areas of focus include:

- Data: new rates, curves, and securities data must be sourced as they become available

- Analytics: new conventions and methodologies must be supported

- Workflow: clients must be able to target and trade using the new rates and conventions

“From a broader ecosystem view, integration with third-party applications is important. Looking at the State Street front-to-back platform, having the ability to integrate the fund accounting systems where the book of record might be recognized in the fallbacks and having that flow through to your performance, risk and analytical systems is essential.”

– Ephraim Hirschfeld

Product Manager, Charles River Development

Source: Industry Dialogue: The LIBOR Transition (State Street)

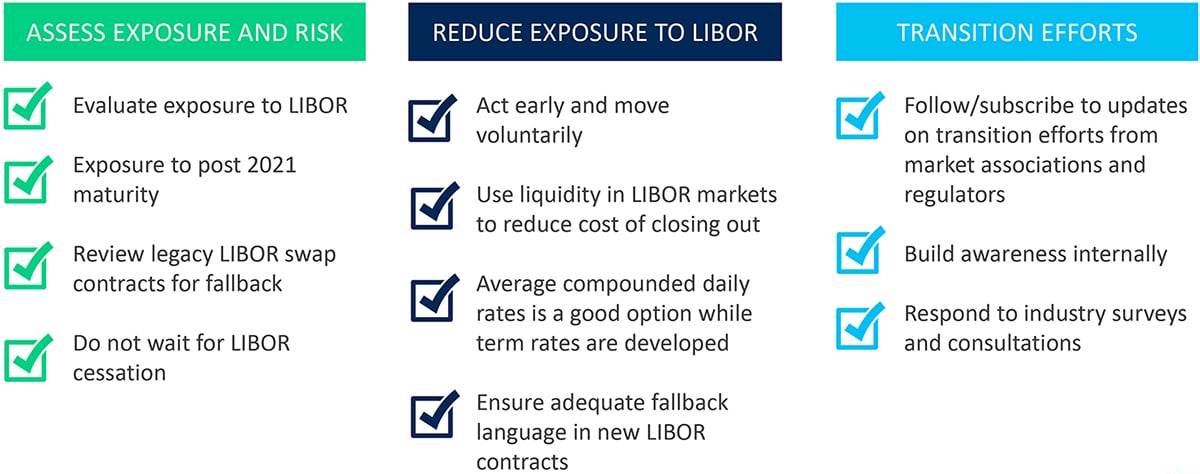

What Should Firms be Doing?

Solution varies by portfolio and strategy – no one size fits all solution.

Industry Dialog: The LIBOR Transition

Technology Challenges & Solutions

State Street’s Lauren Davides and Charles River Development’s Ephraim Hirschfeld provide an overview of the asset classes impacted by the pending retirement of LIBOR, the proposed replacement rates, and the technology challenges associated with the transition.

Retirement of LIBOR

State Street’s Meredith Kaplan and Lauren Davides discuss the history of LIBOR, the factors leading to its retirement as a benchmark interest rate and the impact this will have on investment managers globally.

Readiness and Risks

State Street’s Lauren Davides and Ornella Combaluzier, State Street Global Advisors® discuss industry initiatives to prepare for LIBOR retirement, liquidity trends in the new replacement rates, and risks facing firms as they gauge their current exposure to LIBOR-impacted instruments.