By Peter Sherriff, Director of Product Strategy, APAC.

Asset owners globally are evaluating their operating model to determine what assets and investment activities should be managed internally and which make sense to outsource. Many asset owners with over USD30 billion AUM already view themselves as quasi asset managers, with some mix of assets managed in-house.

Several factors are driving this trend toward “rightsourcing”. Years of subpar after-fee returns by external asset managers have called active management into question. Rapid consolidation between pensions, driven in some jurisdictions by regulatory pressure, leaves firms looking for scale in order to consolidate current and future acquisitions. More recently, the massive dislocations and liquidity constraints in global markets have asset owners looking for greater flexibility and agility to respond to rapidly changing markets conditions.

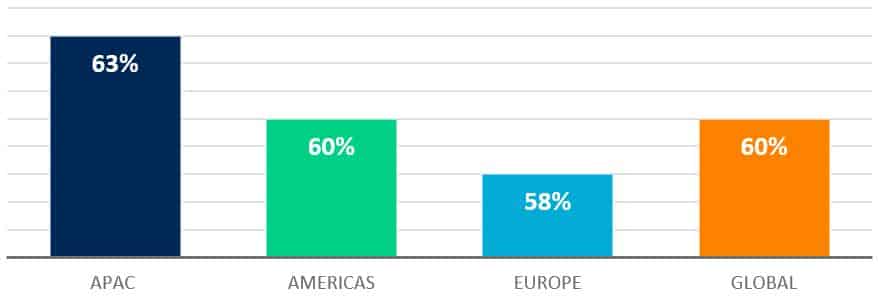

In a recent State Street Growth survey*, 63% of APAC asset owners interviewed confirmed they are consolidating the number of outsourcing partners they use to focus on deeper, more strategic partnerships. The survey found that investment risk monitoring ranked highest on the list of activities asset owners in the region are looking to outsource. At the other end of the spectrum, less than a quarter of firms voiced an interest in outsourced client reporting.

Asset owners on the rightsourcing journey need to identify and prioritise the asset classes and investment operations that make sense to insource, establish robust governance protocols for managing assets, recruit and retain investment professionals across a number of front office roles, and on-board solutions and services required to support asset management.

IDENTIFY & PRIORITIZE

While the majority of assets held by APAC pensions are still managed externally, passive investing and option buy-write strategies are increasingly brought in-house. Asset owners are also managing “best ideas” strategies internally, sourced from insights into the asset classes, sectors and geographies external asset managers currently invest in. Regardless of the percentage of assets insourced, retaining some level of engagement with external asset managers helps asset owners keep informed and direct their investment strategy decisions.

Overlay management is next on the insourcing spectrum, providing a cost-effective way to manage and rebalance asset class exposures using highly liquid exchange traded futures. Buying and selling specific physical securities or holdings in a particular asset class can generate hundreds of trades. Exchange traded futures, or for some organisations index-based ETFs, can achieve the same exposure in a single trade, with the additional benefit of low transaction costs, extended market times, and the ability to easily gain positive or negative exposure.

More specialized activities such as sec-lending are typically still outsourced to custodians due to the high cost of internalisation, and the need for deep subject matter expertise and a strong understanding of counterparty risk and exposures.

ROBUST GOVERNANCE

Asset owner investment boards considering internal asset management must establish a strong governance framework to ensure that insourced assets are properly managed against the firm’s investment policy, risk budgets and return targets. Good governance is an active and ongoing process and should incorporate the same rigor that investment boards apply to external managers. Establishing clearly defined processes for measuring, monitoring and reporting on risk-adjusted performance, changes in asset allocation and expansion into new geographies is key to determining whether the promised benefits of insourcing are realised. Asset owners need to be able to clearly demonstrate to the board that the decision to insource asset management has provided cost savings and/or better returns. Ultimately, insourcing saves on third party management fees but needs to be balanced with the cost of hiring investment staff. Given the nature of the AUM-based fees, this is easier math for much larger institutions. As for better returns, organisations need to show performance against the same benchmarks they were measuring their external managers against.

RECRUITING & RETENTION

Competition for investment management talent can prove challenging. In many countries, compensation structures in public-sector funds lag those in institutional asset management, creating challenges for asset owners looking to recruit and retain portfolio managers, traders and analysts. One paradoxical bright spot is that recent asset manager downsizing has made more talent available for asset owners to hire. Technology plays a key role in helping meet the challenges of recruiting talent. An end-to-end platform with robust analytics, reporting, and multi-asset trading can help fill the gaps and play a meaningful part in helping the organisation achieve its investment goals

SOLUTIONS & SERVICES

Depending on which asset classes and investment processes are prioritised for insourcing, assembling the right mix of technology solutions and outsourced services across the asset owner’s front, middle and back office is key to executing an effective rightsourcing strategy. Traditionally commoditised back office services such as fund administration, collateral management and securities lending may make sense to outsource, while high-value front office activities are top insourcing priorities.

Outsourced trading decisions vary by asset class, geography and trading frequency. Domestic equities can often be run internally, while more complex multi-asset and global products might best be served by outsourcing.

Key to bridging the front and back office is the Investment Book of Record (IBOR). Outsourced IBOR management provides asset owners with an independent source of start-of-day positions across custodians and back office service providers. By delivering consistent, near real-time cash and positions, asset owners can quickly invest new funds, rebalance over- and under-weight allocations, and establish hedges during bouts of market turmoil.

SUCCESSFUL RIGHTSOURCING

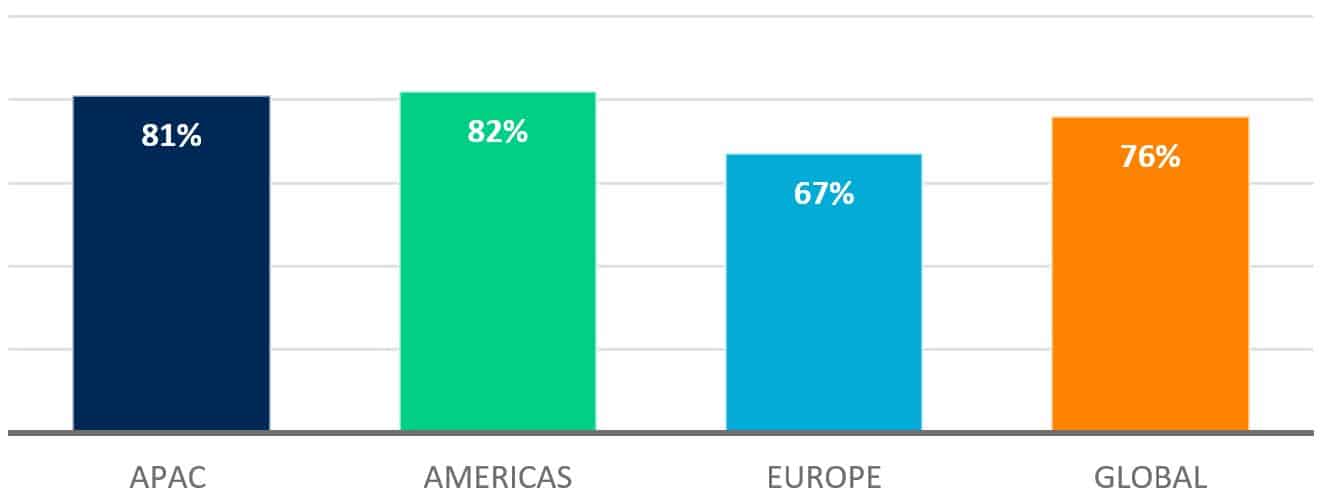

In the State Street Growth Survey mentioned earlier, when asked to prioritise what they value in an outsourcing provider, 81% of APAC asset owners cited robust business continuity plans. Also high on the list is a global presence across regions and having substantial size and scale. With a strong regional presence in APAC and a global footprint, State Street and Charles River offer this in a “follow-the-sun” support model for asset owners investing in multiple geographies.

In the front office, Charles River provides a multi-asset solution that APAC asset owners can leverage, including asset allocation, portfolio management, risk analytics, performance measurement including support for complex multi-manager structures. State Street provides middle and back office services, outsourced trading and regulatory reporting to support their asset class mix.

For many APAC asset owners, this type of hybrid operating model can deliver operational efficiencies, support organisational resilience and enable flexibility to respond to changing market conditions. Partnering with a trusted global solution and services provider such as State Street can help firms ease that transition with minimal disruption.

*State Street Growth Readiness Study, Fourth Edition, Longitude Research, December 2020

3611260.1.1.GBL.

Disclaimers and Important Risk Information

Charles River Development – A State Street Company is a wholly owned business of State Street Corporation (incorporated in Massachusetts).

This document and information herein (together, the “Content”) is subject to change without notice based on market and other conditions and may not reflect the views of State Street Corporation and its subsidiaries and affiliates (“State Street”). The Content is provided only for general informational, illustrative, and/or marketing purposes, or in connection with exploratory conversations; it does not take into account any client or prospects particular investment or other financial objectives or strategies, nor any client’s legal, regulatory, tax or accounting status, nor does it purport to be comprehensive or intended to replace the exercise of a client or prospects own careful independent review regarding any corresponding investment or other financial decision. The Content does not constitute investment research or legal, regulatory, investment, tax or accounting advice and is not an offer or solicitation to buy or sell securities or any other product, nor is it intended to constitute any binding contractual arrangement or commitment by State Street of any kind. The Content provided was prepared and obtained from sources believed to be reliable at the time of preparation, however it is provided “as-is” and State Street makes no guarantee, representation, or warranty of any kind including, without limitation, as to its accuracy, suitability, timeliness, merchantability, fitness for a particular purpose, non-infringement of third-party rights, or otherwise. State Street disclaims all liability, whether arising in contract, tort or otherwise, for any claims, losses, liabilities, damages (including direct, indirect, special or consequential), expenses or costs arising from or connected with the Content. The Content is not intended for retail clients or for distribution to, and may not be relied upon by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to applicable law or regulation. The Content provided may contain certain statements that could be deemed forward-looking statements; any such statements or forecasted information are not guarantees or reliable indicators for future performance and actual results or developments may differ materially from those depicted or projected. Past performance is no guarantee of future results. No permission is granted to reprint, sell, copy, distribute, or modify the Content in any form or by any means without the prior written consent of State Street.

The offer or sale of any of these products and services in your jurisdiction is subject to the receipt by State Street of such internal and external approvals as it deems necessary in its sole discretion. Please contact your sales representative for further information.

State Street may from time to time, as principal or agent, for its own account or for those of its clients, have positions in and/or actively trade in financial instruments or other products identical to or economically related to those discussed in this communication. State Street may have a commercial relationship with issuers of financial instruments or other products discussed in this communication

©2021 STATE STREET CORPORATION