An interview with Peter Sherriff, director of Product Strategy, APAC at Charles River Development.

Like most industries, the only constant in investment management is change. Retaining clients and growing assets under management (AUM) requires firms to differentiate their value proposition, reduce operating costs and carefully manage risks – from operational and financial to regulatory and reputational.

A sophisticated operating model is central to all three of these imperatives. The average operating model shelf life is brief: Firms can either adopt an ongoing evolutionary approach that incorporates the latest technology and best practices or consider a more drastic revolution where the entire model is reevaluated – and in extreme cases, completely replaced.

In this interview, Peter Sherriff discusses how a well-executed revolution can enable a sustainable and ongoing evolution of future operating models for asset owners and investment firms.

Peter Sherriff

Director of Product Strategy, APAC

Charles River Development

Why are so many institutional investors struggling with inefficient and ultimately unsustainable operating models, disconnected systems and data silos, and the lack of agility necessary to differentiate their value proposition?

Many organizations we speak with find their operating models undergo a revolution every seven to 10 years: a cadence that isn’t sustainable. Firms currently caught in this dilemma should seize the opportunity to ensure that the next revolution supports ongoing evolution in the future, which is cost effective and far less disruptive.

Why is this an inflection point? Because operational transformations require greater change upfront to make smaller, ongoing changes in the future easier.

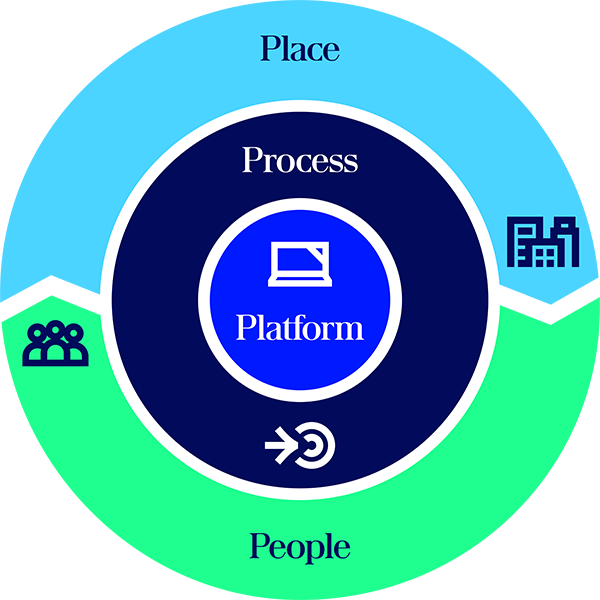

We view an operating model through the lens of the four P’s: people, processes, platform and place. With the right platform underpinning your operating model, process and people can evolve alongside the place where the work is performed without needing to change the platform or process to accommodate a shift in function responsibility.

Having the flexibility to perform a step in the process – either in-house or by an external provider – without having to adapt the other P’s is key. This represents a significant shift from the traditional approach to outsourced services that were performed at a distance and lacked this transparency.

What is operating leverage, and how does it help firms scale their costs in line with ever-changing market cycles?

Historically, technology platforms have used fixed-fee models where costs increase with business volumes, but don’t decrease below a prescribed threshold due to fixed hardware and third-party costs. With the move to a cloud-native, consumption-based pricing, these high fixed costs are being converted to variable costs. When business is growing, costs will increase in line but when experiencing a contractionary phase, the cost base declines. This consumption-based paradigm for technology platforms is now in sync with the reduction in fixed costs that outsourced service arrangements have traditionally provided and enables firms to manage operating leverage regardless of where they are in the cycle.

Why is this important? In-region for example, superannuation funds have brought nearly 25 percent of their book in-house and that trend is ongoing, especially for domestic equities and cash. This is a huge reduction in allocations to the investment firms that previously managed those assets. In such an environment, you need to be dynamic, you need to differentiate, and you need a platform that scales in both directions from a capability and cost perspective.

People are central to operational transformation. What challenges do firms face in creating a culture that supports change?

A successful revolution requires the right people at its core. Change doesn’t come without strong leadership and sponsors to drive it. The change required is significant; it’s not small tweaks around the edges. Leaders must challenge every aspect of their business, identify their true differentiations and be willing to eliminate or outsource non-value added activities.

Secondly, it’s imperative to understand your people and their capabilities, and upskill them when necessary. Cultivating new skill sets internally takes time and resources, while hiring externally can be cost prohibitive or challenging, especially in regions that have a limited local talent pool to recruit from.

Most importantly, it’s about retaining people at every level of an organization who are open to change. Otherwise, organizations remain mired in outdated practices that result in heightened customer attrition, bloated operating costs and increased pressure to merge or be acquired by a competitor.

Partners play a critical role in helping firms rethink their operating models. What do institutional investors expect from these partnerships, and how do we structure those relationships to maximize their value for clients?

When firms build homegrown solutions, they tend to budget well for the build, but underestimate ongoing maintenance costs. Operating system and database upgrades, changes in the broader set of required code libraries, and supporting those new versions becomes prohibitively expensive, so firms tend to fall behind. This increases technology silos across the firm without gaining the benefit of the latest software capabilities. The more firms build, that burden grows, and becomes even more prohibitive when it’s not being appropriately accounted for. Firms should avoid building anything in-house that’s not a true differentiator.

We are increasingly seeing firms looking to forge strong partnerships with their providers, who in turn also partner with each other to deliver meaningful solutions, complementing internal operations teams and helping to control costs.

By relying on partners, organizations no longer have maintenance spend and associated resources to manage. An increasing sentiment we hear from both clients and consultants is that there should be a high dependence on a small number of strategic partners to support the many non-differentiating tasks across the investment process, such as managing the trade order life cycle, compliance, settlements, positions, transactional data and security data. However, labor costs can serve as a critical differentiator, particularly in emerging geographies where hiring internal resources can be more cost effective than outsourcing.

Our platform, State Street Alpha®, provides ongoing maintenance, so a new data set or software version doesn’t require incremental spend from the client, and applies to partners and internally created software. This enables clients to leverage their preferred partners without having to take on the workload, so they can focus on true differentiators.

How are platforms and partnerships redefining modularity and the ease with which non-core capabilities can be added or swapped as firms transition from revolution to evolution?

Once firms have completed a successful revolution and business needs change, the non-core modules (like performance and risk) can evolve more easily, whether it’s internalized or handled by a partner or service provider. None of it matters since the data is still fit-for-purpose and the operational process doesn’t change; you just plug in a different engine.

Platforms are redefining what modularity means. While an investment platform provides core capabilities – such as order and execution management, portfolio and risk analytics, performance attribution and other modules – clients could also opt to use external providers for any of those capabilities, either as technology or as a service.

We’re breaking down that historical barrier where modularity is always internal to a provider, and we are making it external by including partners. With a centralized, no-movement data model underpinning the platform, partners can bring new applications and engines to the data rather than having to move data to each new application. That’s true modularity, leveraging an industry ecosystem that enables clients to tailor their platform to the unique requirements of their product and asset class mix.

How do we help clients as they rethink and transform their operating models to support sustainable growth and differentiation?

State Street is a strategic partner for so many participants across the financial services industry, from investment firms and alternatives managers, to asset owners and insurers.

Our global reach and scale allows us to build strong partnerships across the capital markets ecosystem, enabling clients to leverage those relationships, reducing operational friction and overhead. We’re here to help organizations plan and execute a successful revolution that supports a more productive and streamlined future evolution.

Operating Model Key Elements

- People, both employees and outsourcing providers, and their respective skill sets

- Processes those people are tasked with running

- Where those processes take place, whether externally outsourced or internal to the organization

- The technology platform on which those processes are executed

Contact Us

To learn more about Charles River IMS or to schedule a demo.

6957023.1.1.GBL

The material presented is for informational purposes only. The views expressed in this material are the views of the author, and are subject to change based on market and other conditions and factors, moreover, they do not necessarily represent the official views of Charles River Development and/or State Street Corporation and its affiliates.