Consolidate and Normalize Investment Data Across Asset Classes

For institutions investing in Private Markets, portfolio monitoring is often a challenge due to disconnected data, inflexible in-house systems, and difficulty building custom calculations, workflow, and reporting. Charles River for Private Markets helps solve these by consolidating data from multiple fund administrators, technology point solutions, and spreadsheets. This frees up valuable resources from time-consuming ad-hoc analyses, giving you trusted data quality and access to better insights for decision-making.

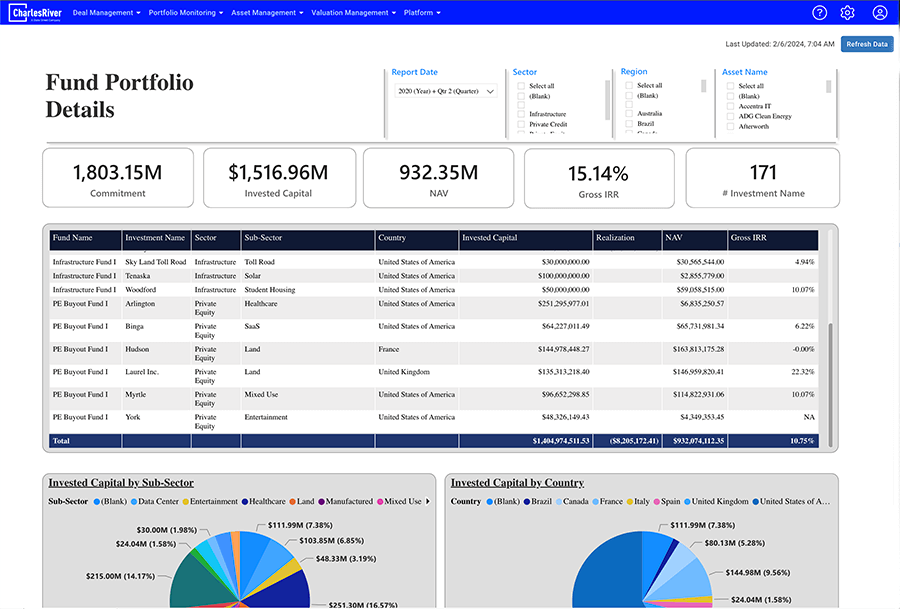

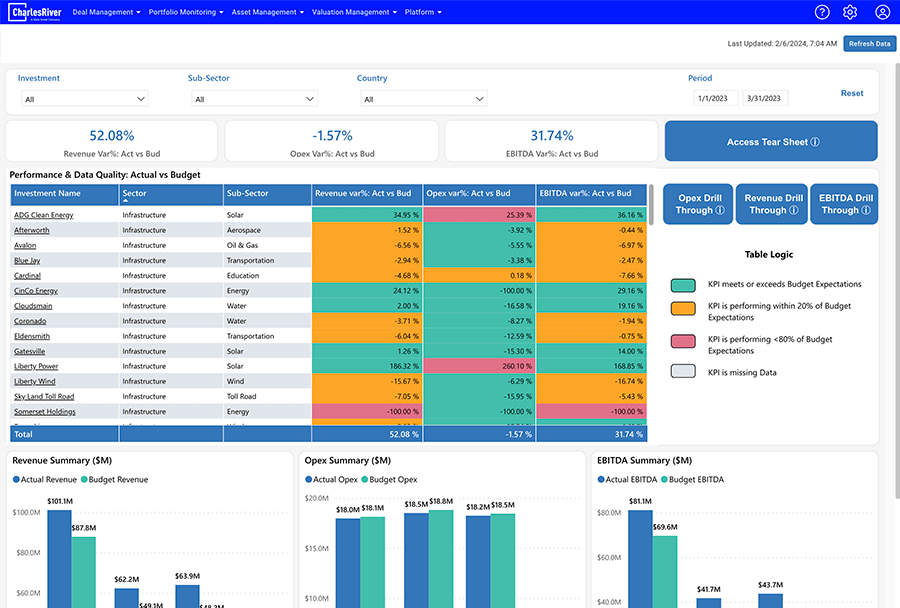

With our Portfolio Monitoring solution, investors in Infrastructure, Real Estate, Private Credit and Private Equity can utilize fully auditable historical fund transaction data to better understand historical performance. Analyze actuals vs forecast for any time frame for any asset or operational KPI. Drill in and filter data by different time-series, sectors, and regions in dashboards. Systematize your Excel-based performance calculations.

Trust Your Data, Gain Better Insights

Charles River for Private Markets consolidates and normalizes investment data into a single platform. Break through your data silos and connect your technology point solutions to unlock access to faster insights and improved response times to LP queries.

Current Challenges

- Ad-hoc investor queries take weeks to respond

- No ability to integrate and normalize data across multiple different fund administration at scale

- Inherently complex to structure accounting data into desired outcomes

- Existing in-house systems have inflexible data output capabilities

- Reliance on Excel as a database for historical data

Solutions

-

Self-service LP inquiries with access to fund and investment data analytics

-

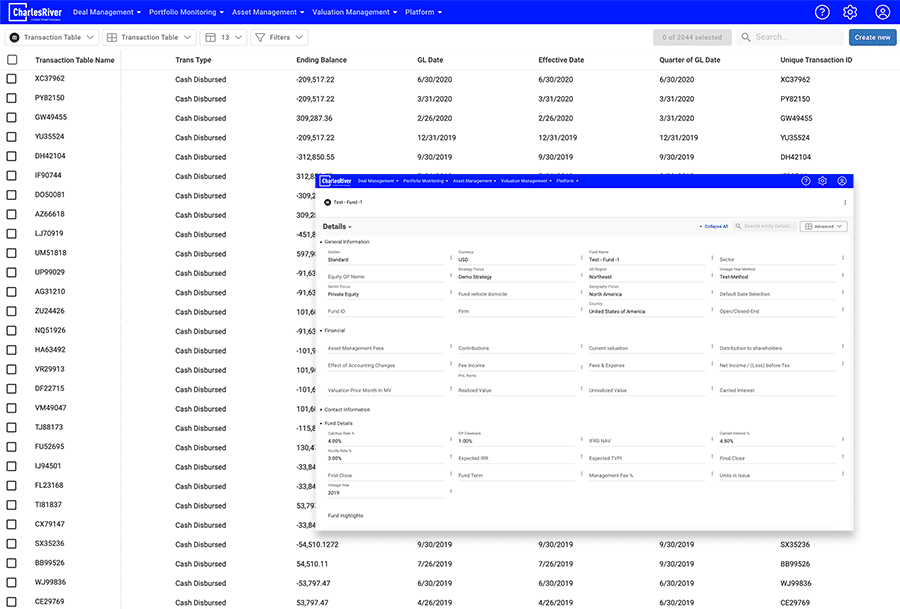

A multi-admin solution that ingests transactions from multiple admins or accounting platforms

-

Configurable & auditable calculation logic with drill-down capability into underlying cashflows

-

Automated reporting at different investment levels across time periods

-

Dynamic filtering to calculate returns across multiple investment sectors and/or regions

Key Capabilities

How our Portfolio Monitoring framework helps solve private market data management challenges.

Calculate, stratify, and drill into fund-level returns by underlying cashflows for each investment and asset.

Proactively manage data quality by drilling into each investment KPI with data variance check.

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.

Request a Demo to Learn More

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.