Deal Activity Transparency

One of the greatest challenges for private market investors deploying capital quickly and efficiently. But when data sits in disparate systems, such as a customer relationship system (CRM), spreadsheets, email, PDFs and external market data sources, deal managers often lack the insights necessary to make investments in a timely way.

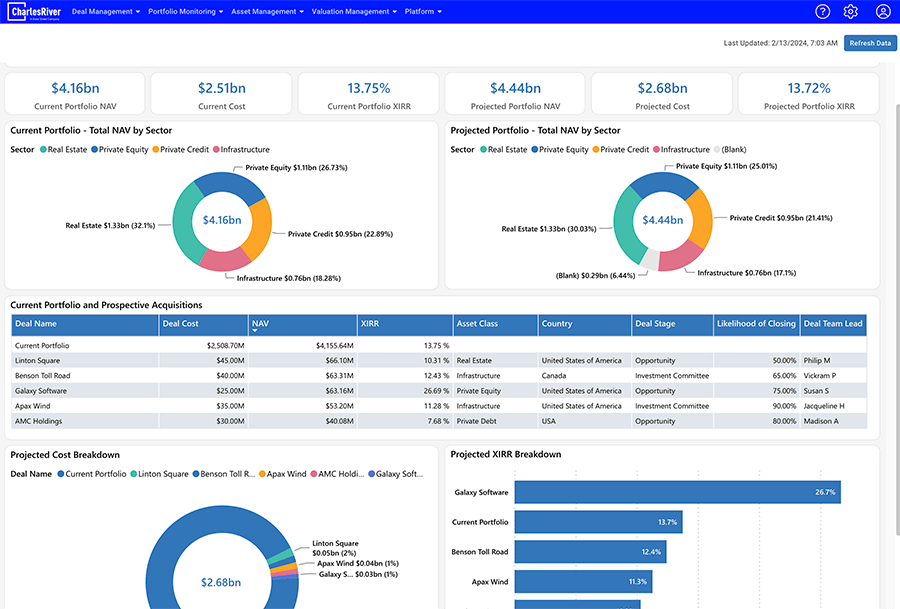

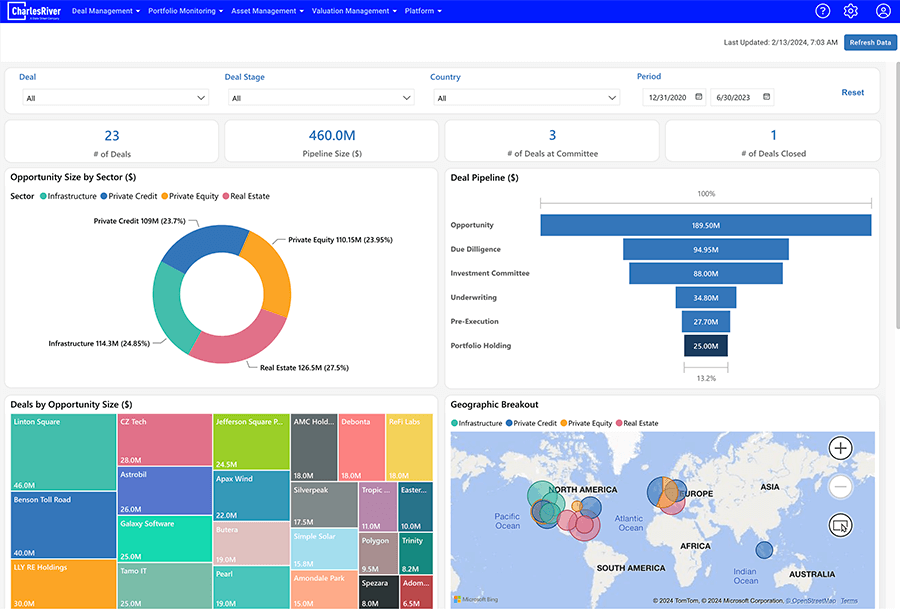

With Charles River for Private Markets, the Deal Management team has all of this data available for making well-informed decisions about new investments. The cloud-based solution consolidates data from spreadsheets, point solutions, fund administrators, and CRMs to give all teams access to a single source of truth for private markets investment data. It enables accretion and dilution analysis across the investment portfolio and provides seamless data transport from pre- to post-investment with total workflow transparency.

Trust Your Data, Gain Better Insights

Charles River for Private Markets consolidates and normalizes investment data into a single platform. Break through your data silos and connect your technology point solutions to unlock access to faster insights and improved response times to LP queries.

Current Challenges

- No transparency into deal activity & valuation across different deal teams

- Struggle to determine new deal’s impact to our fund

- No single place to manage all pre- and post-investments data. Requires manual effort to translate deal data into back-office accounting

- Excessive time allocated to ad-hoc reporting from multiple team members

Solutions

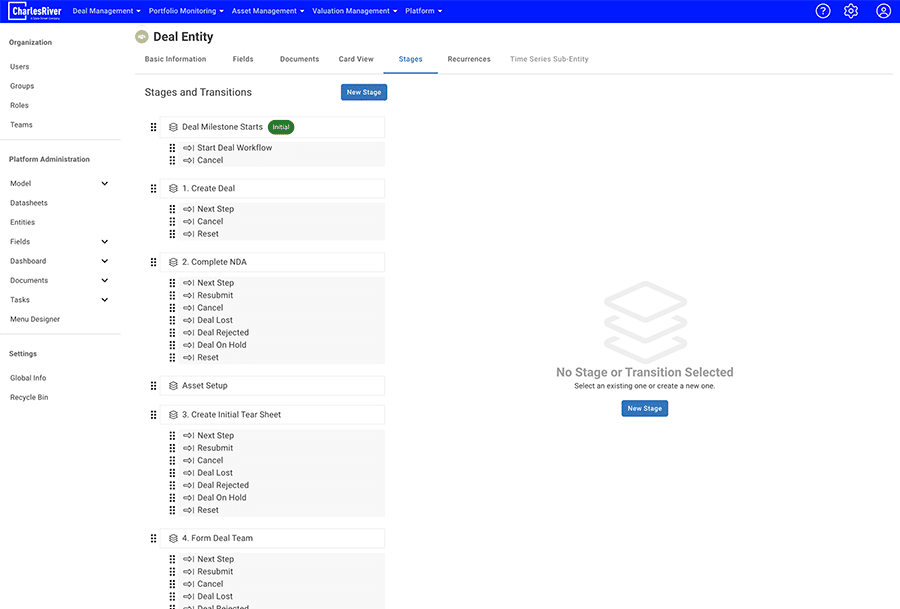

- Ability to institutionalize deal management process with required controls / approvals at each stage including investment hand-off across teams

- Full workflow transparency into data / document changes and approvals

- Single platform to manage all investments and deals data

- Integrated reporting with market research platforms (e.g., Pitchbook) for deal analysis

Key Capabilities

How our Deal Management framework helps solve private market data management challenges.

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.

Request a Demo to Learn More

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.