In 2021, State Street acquired Mercatus, Inc. a premier front-and-middle-office solutions and data management provider for private market managers. In this ongoing series of Insights, Mercatus subject matter experts explain how their technology helps Charles River and State Street clients manage private assets more efficiently, streamline business processes and automate error-prone manual workflows.

What will 2022 bring to the global economy and how will it impact your portfolio? Unfortunately, we don’t have that answer for you. But we do have a way to help you plan for it.

Scenario analysis: It’s not easy to do for private assets and there’s no magic wand to wave to make it work. But with a process and a tool, it is possible to see how your private market portfolio will perform given certain sensitivities in the future.

Planning for the unknown has never been more important, and not just for asset managers. In a recent survey of CFOs, McKinsey found that 90 percent said they are now using at least three scenarios to support their company’s planning. That wasn’t the case before the global pandemic.

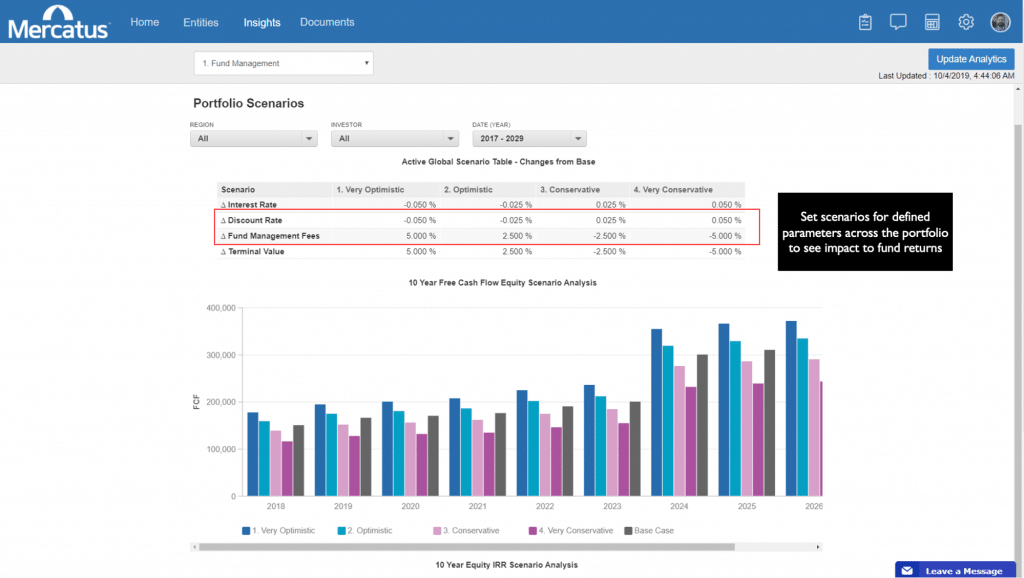

A dashboard on the Mercatus platform helps visualize scenario results in real-time. Screenshots are for informative purposes only, no live data being used.

Unlike scenario analysis of publicly traded assets, where pricing and valuations are readily available, private markets require far more data aggregation to generate realistic forecasts. Many private asset managers still rely on analysts and Excel to manage their investment data, and few have a process to help them determine how a macroeconomic change might impact their portfolio or funds.

But increasingly their investors are asking for these “what if” scenarios. What if interest rates rise and oil prices fall? What if commercial real estate has a dramatic downturn? What if the dollar plummets? Investors who cannot perform scenario analysis can’t see how certain trends present buying moments. They miss out on opportunities to divest certain assets before they crash.

Here we’ll explain how scenario analysis currently can be done across a portfolio with a very manual approach and how it can be improved with a system in place.

How It Works Without a Process and a Tool

Let’s use this fund manager as an example. ABC Infrastructure is a global infrastructure fund with 50 private assets, each with its own financial model. It has a large limited partner (LP) asking what will happen to the portfolio if interest rates change or power pricing decreases in a given region?

If ABC Infrastructure even agrees to deliver the analysis, this is how it happens:

- Requestor sends a list of desired macro pricing updates and sensitivities to the people who manage the individual asset models (e.g., power prices up 5% in one region, wind production down 5% globally).

- Individuals first update each model with actual financial and operating data to have an effective forecast. Then they run the sensitivity analysis one by one, collect the outcomes and send them back to the requestor.

- Requestor aggregates all the data into a single spreadsheet. Requestor is unsure if the data is accurate but has to just assume it is.

Resources needed for this exercise? Roughly 10 people and three weeks’ time. If the requestor wants to tweak the scenario to see a smaller 3% rise in power prices, they must start all over.

How It Works With a Process and a Tool

Now let’s assume ABC Infrastructure has a data management platform to manage its underlying investment data and create ad-hoc reports based on bespoke models housed in Excel. First it created a process, then it was able to deliver analysis for any number of sensitivities across its portfolio.

- ABC Infrastructure implemented a centralized platform that connects to its Excel models at scale. During this implementation, it created a systematic process for onboarding individual assets to ensure that sensitivity analysis can be run on each model.

- Once it defines a desired macro assumption, it chooses the asset models to include. These Excel models have been connected to the data platform, allowing a simple Bulk Calculate function to run the sensitivity.

- A dashboard on the platform helps the team visualize portfolio valuation updates and scenario results in real-time.

Resources needed: Once the technology has been implemented and the process created, macro pricing updates for a global portfolio can be run by one person in 1-2 hours using the power of each asset’s bespoke valuation model.

In summary scenario analysis is a powerful feature that is increasingly becoming imperative for fund managers in the private markets, especially those with large institutional clients as LPs.

4089514.1.1.GBL.

Disclaimers and Important Risk Information

Charles River Development – A State Street Company is a wholly owned business of State Street Corporation (incorporated in Massachusetts).

This document and information herein (together, the “Content”) is subject to change without notice based on market and other conditions and may not reflect the views of State Street Corporation and its subsidiaries and affiliates (“State Street”). The Content is provided only for general informational, illustrative, and/or marketing purposes, or in connection with exploratory conversations; it does not take into account any client or prospects particular investment or other financial objectives or strategies, nor any client’s legal, regulatory, tax or accounting status, nor does it purport to be comprehensive or intended to replace the exercise of a client or prospects own careful independent review regarding any corresponding investment or other financial decision. The Content does not constitute investment research or legal, regulatory, investment, tax or accounting advice and is not an offer or solicitation to buy or sell securities or any other product, nor is it intended to constitute any binding contractual arrangement or commitment by State Street of any kind. The Content provided was prepared and obtained from sources believed to be reliable at the time of preparation, however it is provided “as-is” and State Street makes no guarantee, representation, or warranty of any kind including, without limitation, as to its accuracy, suitability, timeliness, merchantability, fitness for a particular purpose, non-infringement of third-party rights, or otherwise. State Street disclaims all liability, whether arising in contract, tort or otherwise, for any claims, losses, liabilities, damages (including direct, indirect, special or consequential), expenses or costs arising from or connected with the Content. The Content is not intended for retail clients or for distribution to, and may not be relied upon by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to applicable law or regulation. The Content provided may contain certain statements that could be deemed forward-looking statements; any such statements or forecasted information are not guarantees or reliable indicators for future performance and actual results or developments may differ materially from those depicted or projected. Past performance is no guarantee of future results. No permission is granted to reprint, sell, copy, distribute, or modify the Content in any form or by any means without the prior written consent of State Street.

The offer or sale of any of these products and services in your jurisdiction is subject to the receipt by State Street of such internal and external approvals as it deems necessary in its sole discretion. Please contact your sales representative for further information.

State Street may from time to time, as principal or agent, for its own account or for those of its clients, have positions in and/or actively trade in financial instruments or other products identical to or economically related to those discussed in this communication. State Street may have a commercial relationship with issuers of financial instruments or other products discussed in this communication

©2022 STATE STREET CORPORATION