by Jay Hinton and Sean Jacobs

Look at any marketing material for a trading application, and you’ll quickly come to the conclusion that the trading applications of the future will have no grids—it will be all graphs, blinking lights and price tiles. At the same time, there’s a joke in the Order Management System (OMS) world that your product doesn’t have to be amazing—it just has to be better than Microsoft® Excel®.

Excel is ubiquitous, in large part because it’s really useful. Ask anyone of a certain age who grew up without it, and you’ll hear tales of what it used to mean to maintain paper based spreadsheets, books and records, journal entries or models — all of which Excel does quite handily. The funny thing is that both sentiments are wrong, and both are true.

Naturally the first order management systems replicated what was being done on paper. We’ll explore that, and the impact that tickets and general skeuomorphism has had on trading applications in another article, but for this piece we’ll look specifically at why the grid is useful, why it’s not, and…spoiler alert: why it’s not going away.

A Brief History of Grids

Because data grids have been around for over two thousand years, they are familiar and readily understood. But, because they have been around for so long, they can also be considered by some to be boring, stale, or dated – particularly when computing power today can offer alternatives to the data grid. Some developers do anything they can to avoid the grid. But just because we can, does not mean we should stray from the grid.

One of our favorite examples was a large asset manager’s take on a ‘Next Generation’ order blotter. In this tool, each order displayed as a large tile on a canvas that acted as a horse race track where the order tile progressed from left-to-right as it reached different states moving towards completion (take ownership, placed, partially filled, filled). Additional order details were only available in hover mode. While this ‘Next Gen’ blotter certainly looked cool, its overall utility was summed up best by a trader whose first question was – “how do I go back to my blotter grid?”

This new design took away many benefits offered by data grids that traders intrinsically value in their blotter. The focus of the new design was on state/progress – something that can be easily understood by a single data grid column such as Status or Percent Done. Moreover, it occupied significant real-estate (grids can handle significant information density), removed sorting capability (a grid strength), and offered little additional data / analytics (grids can be performant even when displaying many data columns).

In short, the sponsors of this tool solved a problem that didn’t really exist, all in the name of trying to stray from the data grid. It is our job as developers for the buy-side community to communicate data effectively and not necessarily to entertain or dazzle. In some cases, the grid may be the boring choice, but also the right choice.

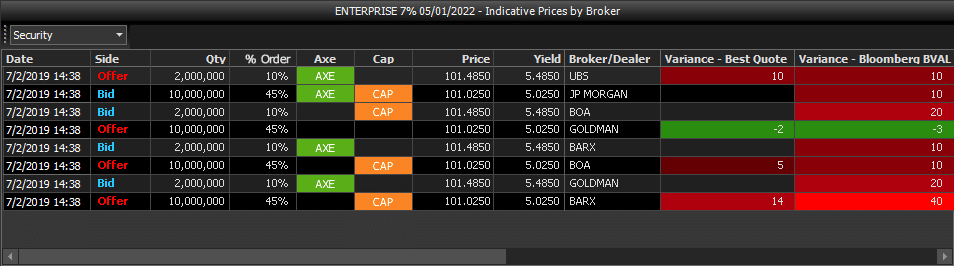

Example data grid in Charles River Trade Blotter. No live data being used.

When to Grid and When Not to Grid

While at one time it was thought that the sum of human knowledge was housed entirely within the four walls of the Library of Alexandria, today we have an ever increasing amount of information – all thanks to the rise of big data. Big data is about much more than storing a large body of information in books on library shelves though. The idea is that we can learn from this information things that we otherwise would not even know or comprehend.

Big data has also reached the trader desktop where traders can likely access any piece of information from venue analysis, micro-structure data, historical broker performance, pre-trade TCA data, real-time and historical IOI data, security analytics, and past trade activity to name a few. The challenge for trading technology tools today isn’t just to display that data, but to help traders derive actionable insights in real time to better help them navigate a dynamic market environment.

Historically, the easiest and simplest way to display data was in the form of a data grid and to simply show the numbers. After all, tables have been around since the Library of Alexandria so they can be readily understood by anyone who can read. But is that what’s best? A rule of thumb when thinking about how to display your information – consider your user and ask yourself the question, how will the information be used?

Data grids are good at displaying simple relationships between multiple values (think columns) and supporting comparison across each other (think rows). Tables are also really useful when precision is required, as the data in its rawest form will be directly displayed in the grid. But in some cases, the focus might not be on the individual values, but rather on the data series as a whole. In cases where identifying patterns and trends or quickly spotting outliers, a chart such as a heat map, histogram, or bubble chart might offer a better visualization to convey your message. And this is why you must always consider your user and what you want them to learn when choosing your display mechanism – particularly in a world of exploding data volumes.

Grid Strengths

Grids are most useful in two situations: when you’ve got a small-ish amount of data to show that stays fairly static, and the users know what they’re looking for, even if the software developer doesn’t. The ability to do ad hoc queries where you don’t know what the user might be looking for in pivot grids, with modern standard features like inline filters, grouping, expanding/collapsing pre-sets, is a significant productivity enhancer.

When you add support for draggable columns, columns that show derivative data that’s being computed somewhere else with no coding required, you end up with a tool that’s extremely powerful for the ad hoc organization of important data.

You also get a relatively lightweight solution (from a computing perspective) that can work across asset classes and data types. So whether you’re looking at equities executions, OTC derivatives orders, or fixed income inventory, all the information about the objects can be displayed.

Effective data grids allow users to analyze, scan, compare, filter, sort and manipulate information to derive insights and take action. Data grids now support a variety of design structures, information hierarchies, and interaction patterns to help viewers better consume the data.

Grid Problems

If that is true, then why are grids being displaced in a modern trading environment? In two words: information density. If your application *only* has grids, it’s going to suffer from uniform information density, regardless of whether it’s used for compliance, trading or portfolio management. This is a problem because it makes it difficult for users to tell what they need to focus on at any given point. If all your data looks the same, the product will be hard for traders to use. Trading is, quintessentially, about figuring out what the most important thing to focus on is, right now. Time and effort spent in trying to make that decision increase the trader’s cognitive load.

Additionally, if your grids are “free standing” and can only display a fixed set of data, you end up with dozens of specialized windows, all of which need to be monitored, and no easy way to be alerted to the important ones. This can be particularly challenging for desks covering multiple asset classes.

There are other more general problems that come with the digital grids of today. Luckily, designers have tools to help combat these:

Scanning

Scanning can often pose a problem for users. A trader might have an order grid maximized across the breadth of a 36 inch large monitor. That could be over 5000 pixels of horizontal scanning a trader will move across when analyzing a given order! As the width stretches, it’s easy for users to lose their vertical position and confuse their location on the grid.

Designers can alleviate this scanning problem by incorporating white space, grid lines, and alternate row colors to help users stay oriented and scan a data grid efficiently and accurately. The trick here is to be minimalist in your approach: less is more when design elements are minimized in the grid. Vertical grid lines have been shown to actually detract from users’ ability to scan data. Replace vertical grid lines with white space between columns (even a few pixels is enough) that are properly aligned by their data type. Words should be left-aligned, numbers right-aligned, and graphics/icons centered. Conversely, a light zebra-striping with minimal contrast between the alternating rows helps users scan rows in a table – particularly in wider grids spanning more than 7 columns.

Scrolling / Pagination

Digital grids can in theory display an endless amount of columns and rows with scrolling to support access to data ‘below the fold.’ The obvious challenge here is that now users can only analyze what they can see.

Paging through 50 or even 100 records at a time has been shown to frustrate users. Lazy-loading where the application automatically loads more records as the users scrolls the table offers a more satisfying experience.

Users should also be able to sort, filter, and search the entire data grid on-demand, regardless of what is visible to help navigate large data sets. And similarly, many data grids today offer a built-in alerting capability where users can create self-service alerts from the grid when a certain data cell reaches a threshold or changes state. These tools all help users navigate large data grids.

Graphical Overview

Often traders are working a large order pad containing hundreds or even thousands of orders. Effectively monitoring these via a data grid is near impossible. When managing large data sets, we always think of data guru Ben Shneiderman’s mantra: “Overview first, Zoom and Filter, then Details on Demand.” Instead of showing the full order pad, we can look to provide a graphical overview through a visual first using the underlying data grid.

Perhaps a better overview to the trader understanding their order blotter would be a heat map where orders are grouped by status, the tile size shows the order amount, and the tile color density communicates order Implementation shortfall. Now a trader can quickly see how much of their order pad is being worked, where there largest orders are, and what orders are performing well or not.

When the trader needs to zoom in and filter by status or poorly-performing orders, a quick toggle to the full data grid should be a click away. And of course the details on demand should all be immediately accessible in the relevant data columns.

Overall, while grids have some inherent shortcomings, today’s technology provides developers with the needed tools to let the data shine.

A hybrid paradigm

The grid becomes supremely useful when it serves a dual role: it displays specific, easily customizable data sets, but also serves as the hub in a platform that provides the user with smart linking schemes, where the grids are contextually linked to show either more granular info (example—order performance), or information about the selection in relation to something else (order performance within a portfolio)

The other key capability is to have grids that change configuration so that grids grouped together—execution views, for example—change together when whatever they’re linked to changes. So if a listed futures order is selected, Level 2 data changes to match futures ladders style formatting, and if an equities order is selected, a consolidated market depth view is displayed, hiding and displaying the relevant controls without asking the user to do anything.

We said before that you don’t know what the user might be looking for. The twist here is while “You don’t know what the user might be looking for—and neither do they!” Graphics can help to reveal relationships, and create valuable insights from data.

Enriching the grids with graphic elements also shifts this balance. UI designers have added sparklines (thanks Tufte!), icons, flags, and graphic elements. For example, adding color shading to the cell background through conditional formatting to alert traders when data breaches a certain threshold helps highlight salient data points where appropriate. The data grids and their capabilities today are much more advanced – giving software developers better tools to tell a story about the data.

In the end, the grid will never go away completely. As a utility, it offers far too much flexibility to the user and serves as a coordinating mechanism across multiple domains.

So, like the old king, the grid is dead. But, used correctly, it’s still one of the most powerful tools on the desktop. So, long the live the king!

3082973.1.1.GBL.

Disclaimers and Important Risk Information

Charles River Development – A State Street Company is a wholly owned business of State Street Corporation (incorporated in Massachusetts).

This document and information herein (together, the “Content”) is subject to change without notice based on market and other conditions and may not reflect the views of State Street Corporation and its subsidiaries and affiliates (“State Street”). The Content is provided only for general informational, illustrative, and/or marketing purposes, or in connection with exploratory conversations; it does not take into account any client or prospects particular investment or other financial objectives or strategies, nor any client’s legal, regulatory, tax or accounting status, nor does it purport to be comprehensive or intended to replace the exercise of a client or prospects own careful independent review regarding any corresponding investment or other financial decision. The Content does not constitute investment research or legal, regulatory, investment, tax or accounting advice and is not an offer or solicitation to buy or sell securities or any other product, nor is it intended to constitute any binding contractual arrangement or commitment by State Street of any kind. The Content provided was prepared and obtained from sources believed to be reliable at the time of preparation, however it is provided “as-is” and State Street makes no guarantee, representation, or warranty of any kind including, without limitation, as to its accuracy, suitability, timeliness, merchantability, fitness for a particular purpose, non-infringement of third-party rights, or otherwise. State Street disclaims all liability, whether arising in contract, tort or otherwise, for any claims, losses, liabilities, damages (including direct, indirect, special or consequential), expenses or costs arising from or connected with the Content. The Content is not intended for retail clients or for distribution to, and may not be relied upon by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to applicable law or regulation. The Content provided may contain certain statements that could be deemed forward-looking statements; any such statements or forecasted information are not guarantees or reliable indicators for future performance and actual results or developments may differ materially from those depicted or projected. Past performance is no guarantee of future results. No permission is granted to reprint, sell, copy, distribute, or modify the Content in any form or by any means without the prior written consent of State Street.

The offer or sale of any of these products and services in your jurisdiction is subject to the receipt by State Street of such internal and external approvals as it deems necessary in its sole discretion. Please contact your sales representative for further information.

©2020 STATE STREET CORPORATION